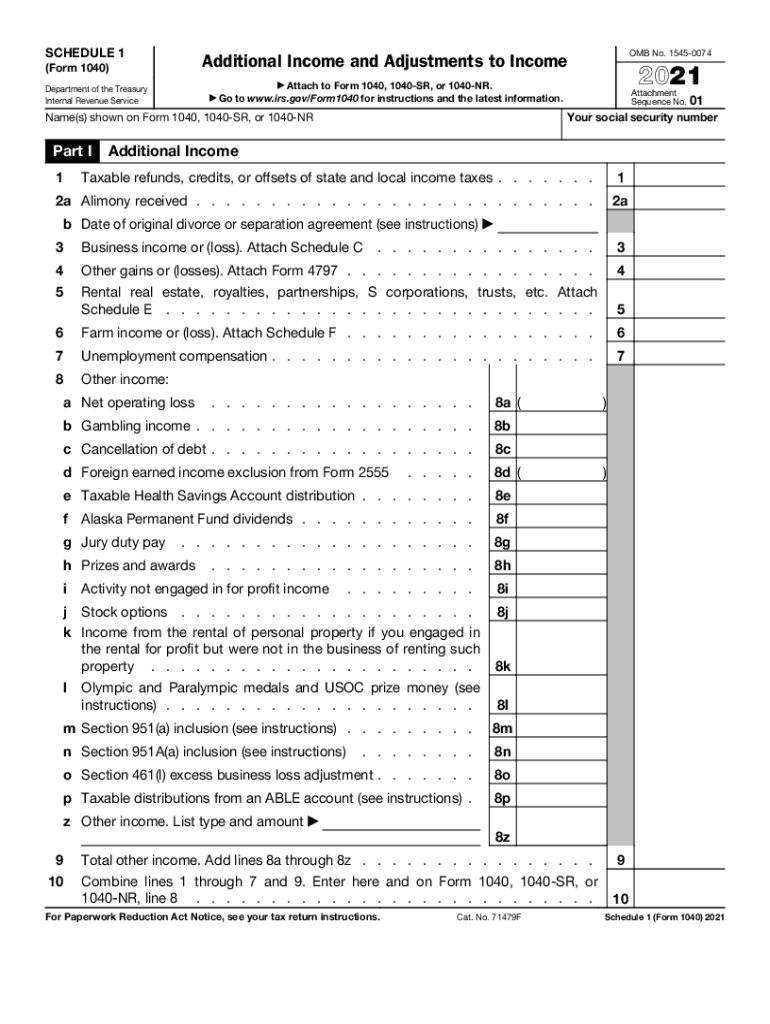

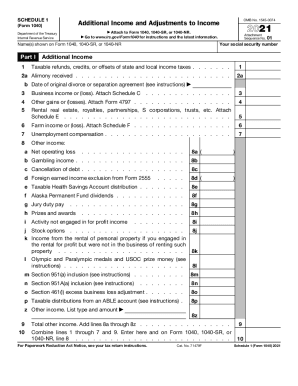

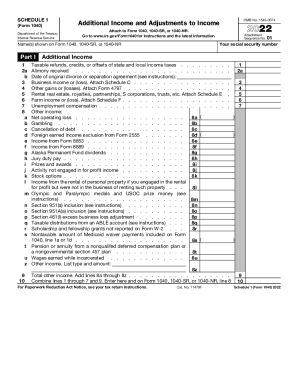

2024 1040 Schedule 1 Instructions Form – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the are not listed on the standard Form 1040. It includes sections for reporting . Form 1040, Schedule C, Line 1 Report all money you collected in your business on Line 1 of Schedule C. This amount should include all commercial sales taxes you collected. You do not need to .

2024 1040 Schedule 1 Instructions Form

Source : www.irs.gov2022 schedule 1: Fill out & sign online | DocHub

Source : www.dochub.comIRS Schedule 1 walkthrough (Additional Income & Adjustments to

Source : m.youtube.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS 1040 Schedule 1 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.org1040SCHED1 Form 1040 Schedule 1 Additional Income and

Source : www.nelcosolutions.comTax season begins: What to know for filing this year | VPM

Source : www.vpm.orgAP | Tax season is under way so how do we navigate? | Laurinburg

Source : www.laurinburgexchange.comIRS 1040 Schedule 1 2022 2024 Fill and Sign Printable Template

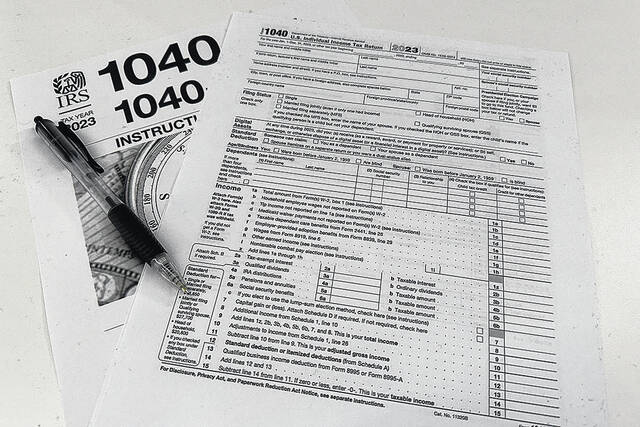

Source : www.uslegalforms.com2024 1040 Schedule 1 Instructions Form 1040 (2023) | Internal Revenue Service: On 1/22/24, the IRS reminded or transferred it during 2023 must use Form 8949, Sales and other Dispositions of Capital Assets, to figure their capital gain or loss on the transaction and then . Form 1040-SR uses the same line items and instructions as the Standard Form such as Schedules 1, 2, and 3, to report information not directly reported on Form 1040-SR. TurboTax Premier .

]]>